This is the 4rd Day course in a series of 60-Days called “Technical Analysis Training”

You will get daily one series of this Training after 8 o’clock night (Dinner Finished)

Follow MoneyMunch.com Technical Analysis Directory and Learn Basic Education of Technical Analysis on the Indian Stock Market (NSE/BSE)

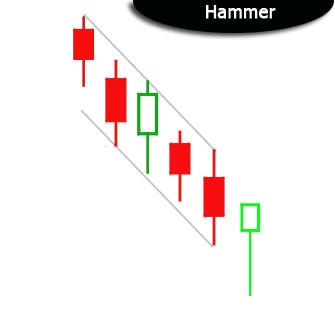

Hammer Candle Stick Chart Pattern

Effects of Hammer

The Hammer indicates that the last downtrend is about to end and also might reverse with an uptrend or move sideways. This excellent pattern is an sign of the financial instrument’s SHORT-TERM view.

Story

The Hammer is characterized by a small Real Body near the top of the price range. The Real Body can be black or white, although a white candlestick is preferable. A white candlestick is slightly more bullish since it shows that the market sold off sharply during the session and then rebounded to close slightly above the opening price level. The Hammer has a long Lower Shadow and an Upper Shadow that is very small or non-existent.

Trading Factors

In cases just where a major uptrend accompanied by a Hammer exists, the investor should consider vacating short opportunities.

Factors that Support

- A Hammer can be confirmed from a bullish gap between the Actual Body of the Hammer and additionally the open upon the next session. In different phrase, the investor must seek out the next session orifice greater than the actual Body of the Hammer. The elevated the gap, the more potent the alert.

- The Hammer can be stronger if in case the subsequent session shows a processed Real Body having a close above the close of the Hammer.

- A Hammer is much more significant if it is followed within the following session by yet another Hammer with superior qualities.

- Layouts with greater Lower Shadows have greater significance.

- The lighter the Real Body as well as the Upper Shadow the better the significance of the pattern.

Factors which Oppose

- It is vital to view tells in the context of last price action. If in case the downtrend is powerful and additionally indeed there are major bearish signs prior to the Hammer, then your Hammer may well not work. In this instance, it may be better to delay for bullish confirmation right before acting.

- The downtrend might continue to be in demand if or when the next session opens up lower than the Real Body of the Hammer.

- A Hammer having a black colored Actual Body (just where the open is high than the close) may indicate tiredness within the pattern.

A long Lower Shadow along with the positioning of the actual Body close to the top of the number are really both evidences which the bears could not maintain brand new lows. This creates the bullish situation.

Message for you(Trader/Investor): Google has the answers to most all of your questions, after exploring Google if you still have thoughts or questions my Email is open 24/7. Each week you will receive your Course Materials. You can print it and highlight for your Technical Analysis Training.

Wishing you a wonderful learning experience and the continued desire to grow your knowledge. Education is an essential part of living wisely and the Experiences of life, I hope you make it fun.

Learning how to profit in the Stock Market requires time and unfortunately mistakes which are called losses. Why not be profitable while you are learning?

TABLE OF CONTENTS

Candlestick and Chart Patterns (15 Days)

7 Most Important Candlestick Chart Patterns

- Gap Down Chart Pattern

- Gap Up Chart Pattern

- Gravestone Short-term Chart Pattern

- Hammer Candle Stick Chart Pattern

- Hanging Man Short-term Stock Chart Pattern

- Inverted Hammer Stock Chart Pattern

- Shooting Star Candle Stick Pattern

Top 2 Bearish Chart Patterns

Top 6 Bullish Chart Patterns

- Engulfing Line (Bullish) Chart Pattern

- Exhaustion Bar Chart Pattern (Bullish)

- Inside Bar Chart Pattern

- Island Bottom Chart Pattern

- Key Reversal Bar (Bullish) Chart Pattern

- Two Bar Reversal (Bullish) Chart Pattern

Indicators & Oscillators (12 Days)

Bullish or Bearish Indicators

Bullish or Bearish Oscillators

- Bollinger Bands Oscillator

- Commodity Channel Index (CCI)

- Fast Stochastic Oscillator

- Know Sure Thing (KST) Oscillator

- Momentum Oscillator

- Moving Average Convergence/Divergence (MACD) Oscillator

- Relative Strength Index (RSI)

- Slow Stochastic Oscillator

- Williams %R Oscillator

Classic Chart Patterns (29 Days)

Bearish Classic Chart Patterns

- Continuation Diamond (Bearish) Chart Pattern

- Continuation Wedge (Bearish)

- Descending Continuation Triangle Chart Pattern

- Diamond Top Chart Pattern

- Double Top Chart Pattern

- Downside Break Chart Pattern – Rectangle

- Flag Bearish Chart Pattern

- Head and Shoulders Top Chart Pattern

- Megaphone Top Chart Pattern

- Pennant Bearish Chart Pattern

- Rounded Top Chart Pattern

- Symmetrical Continuation Triangle (Bearish)

- Top Triangle/Wedge Chart Pattern

- Triple Top Chart Pattern

Bullish Classic Chart Patterns

- Ascending Continuation Triangle Chart Pattern

- Bottom Triangle Or Wedge Chart Pattern

- Continuation Diamond (Bullish) Chart Pattern

- Continuation Wedge Chart Pattern (Bullish)

- Cup with Handle Bullish Chart Pattern

- Diamond Bottom Chart Pattern

- Double Bottom Chart Pattern

- Flag Bullish Chart Pattern

- Head and Shoulders Bottom Chart Pattern

- Megaphone Bottom Chart Pattern

- Pennant Bullish Chart Pattern

- Round Bottom Chart Pattern

- Symmetrical Continuation Triangle Bullish

- Triple Bottom Chart Pattern

- Upside Breakout Chart Pattern – Rectangle

Best Trading Theories (4 Days)

- Basics of Dow theory trading strategy forecasts

- Motive (Impulse) Waves

- Corrective Waves

- Wyckoff Chart Reading

Kind attention: this course is helpful for beginner and intermediate traders. It’s free for everyone. Advanced modules, trading strategies, and data (in-depth) are available for Moneymunch’s premium subscribers.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.